Stage 3

The bottom-up stock selection occurs at stage three of the investment process.

The portfolio managers and Research Analysts review and discuss the Macroeconomist’s recommendations. The Investment Management Team then re-ranks the countries based upon the relative value available within the CoL universe of closed-end funds.

The stock selection process at this stage will identify a number of closed-end funds to give the desired country exposure, guided by our country allocation model. In effect, we will have identified the best performing funds, at the widest discounts to NAV, to give the most potentially profitable country exposure. Some of the funds selected will potentially be subject to a corporate event (liquidation, open-ending, etc.) that may lead to an accelerated return of capital at NAV.

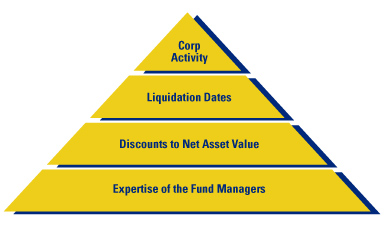

The following four valuation components summarize the key drivers in our stock selection process:

- The historical, net performance of the closed-end fund in NAV terms, versus its benchmark.

- The current discount to NAV of the fund compared to its historical average and its peer group.

- Pre-determined fund liquidation date, if any.

- The potential for the fund’s discount to NAV to narrow due to unitization (conversion to open-ended status), a share buy back program or some other form of corporate activity.