Cross-Asset Quarterly Outlook

September 2024*

Rising risks, but it is still too early to cry wolf

- US labour market data is signalling rising recession risks, but the broad set of economic and earnings data still indicates a more benign growth slowdown.

- The Fed is expected to start cutting rates this month, providing support for fixed income assets. Lower-quality credit is less likely to benefit if US growth continues to soften.

- Our asset allocation favours an overweight to rates and commodities versus an underweight to credit, while equities remain neutral.

- This quarter, we added exposure to precious metals and reduced US IG credit.

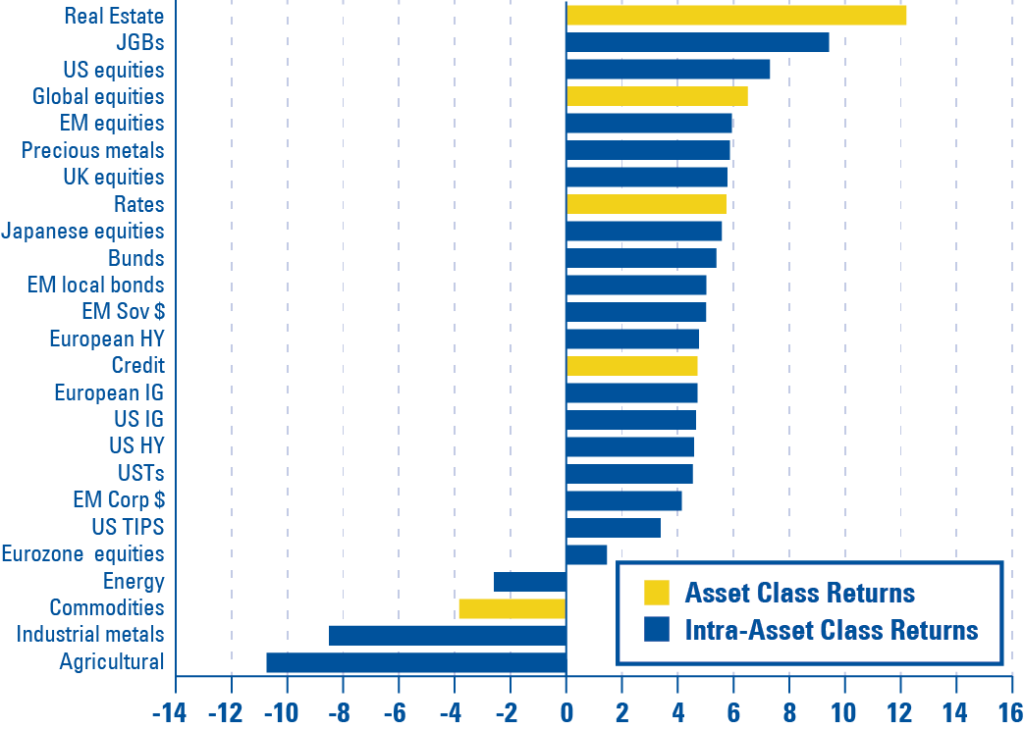

The summer of 2024 was eventful for markets. Volatility (as measured by the VIX) spiked, US recession chatter re-intensified, and AI-related stocks came under some pressure. Despite some signs of underlying weakness in the macro backdrop, global equities still reached new highs. However, the upward trend has become bumpier, and traditional safe havens (e.g. fixed income, precious metals, and the JPY) performed better in recent months (see chart 1).

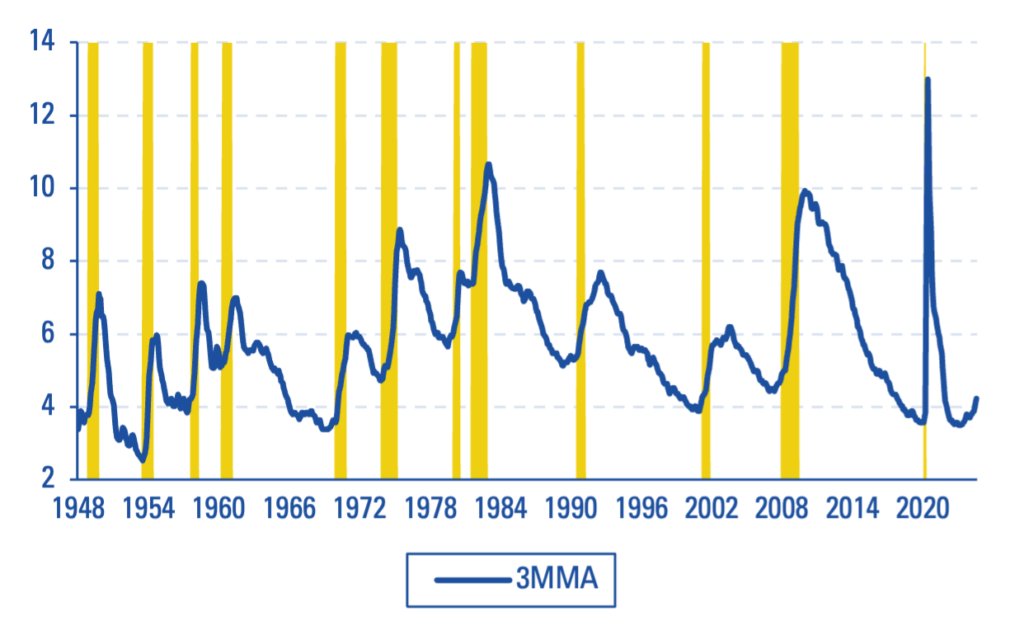

Our baseline view remains a ‘muddle-through’ scenario with slower global growth but where the US avoids a recession over the next 6-12 months. However, the tail-risk scenario probabilities have risen. The rise in the US unemployment rate is an ominous signal that is historically associated with a US recession (see chart 2). There are some caveats to the recent rise in the unemployment rate, including an increase in labour supply rather than layoffs. Still, the reliability of the signal historically means one should not totally discount weakening labour market trends. We adjusted our recession probability upwards to 30%, and our allocations reflect a gradual shift to more defensive assets.

Lagged effects from tight monetary policy are one factor weighing on activity. Over 2022-23, the Fed increased interest rates by 525bp, and recent data indicates that tighter policy is weighing on activity, as evidenced by cooling inflation pressures and a softening labour market. Waning pandemic savings and less fiscal support may also contribute to a further deceleration in US growth. Fed rate cuts will incrementally reduce these headwinds, but the policy feedback will be lagged. Still, equity markets may react positively to Fed policy easing. Historically, US equity market performance is positive in the 3-6 months following the first rate cut if a recession is avoided (1995, 1998, and 2019), while performance was negative when the cut was associated with a recession (1990, 2001, and 2007). 2020 was an exception where there was a recession, but markets rebounded sharply following rate cuts.

On a more optimistic note, we still see evidence of strength in the tech cycle. In particular, artificial intelligence (AI) remains a structural theme. There are questions over how some companies will profit from AI and what earnings forecasts and valuation multiples are reasonable for the most optimistically priced US tech stocks. However, there is clear evidence of growth in tech hardware/semiconductor demand and data centres required to power AI. Global semiconductor sales and Taiwan/South Korea exports are rising to meet growing demand (see chart 3). Guidance from large US tech firms suggests these trends will persist for some time. As a result, any weakness in the tech cycle is likely to be shallow relative to past downturns.

Chart 1: Asset Returns, Jun-Aug, %

Source: Bloomberg

Chart 2: US Unemployment Rate (%)

Source: Bloomberg

*The publication reflects asset performance up to August 30, 2024, and macro events and data releases up to September 6, 2024, unless indicated otherwise.

The information contained herein is obtained from sources believed by City of London Investment Management Company Limited to be accurate and reliable. No responsibility can be accepted under any circumstances for errors of fact or omission. Any forward looking statements or forecasts are based on assumptions and actual results may vary from any such statements or forecasts.