Emerging Markets CEF Investment Process

Our Investment approach combines a Top-Down Macro Process with Bottom-Up Stock Picking. Our Macroeconomic Team is responsible for analysing and ranking the countries in our investment universe while the Investment Team selects stocks based upon several criteria, outlined in the sections below.

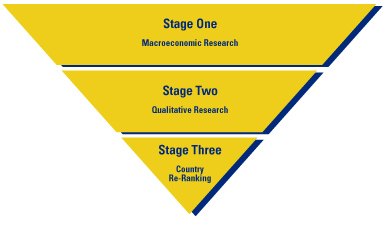

Twenty-five percent of CoL’s value added is via our top down country allocation methodology. This top down element is a three-stage process:

Stage 1

Our Macroeconomists collect relevant economic data on all of the countries that comprise our various benchmark indices. This information is derived from numerous business and governmental sources within these countries as well as supranational organizations. CLIM supplements this data with in-house research to form a quarterly databank of key, leading economic indicators for our country universe. A continuous assessment of political risk in each country within this universe is an integral part of the Stage 1 process. A view is taken of the degree of political stability and whether the political situation in each country is conducive to investment. While necessarily subjective, the process assesses the maturity of the political system and institutional framework, the level of democracy and fairness of the election process, the election calendar i.e., presidential, prime ministerial, parliamentary, gubernatorial and municipal elections and foreign policy stance. The Stage 1 process also takes into account whether the government is eager to maintain good relations with multilaterals, such as the International Monetary Fund and World Bank, and co-operates with neighboring states through a regional economic/political forum, for example, through ASEAN or NAFTA.

Stage 2

Our Macroeconomists analyse the collated information in depth and ranks the countries from the most favored, or best positioned, to least favored based upon a number of key economic criteria using a mix of judgment and experience, This results in recommendations of “overweight”, “neutral” or “underweight” versus the constituent countries of each strategies’ benchmark indices.

- Annual % rate of growth in real GDP

- Industrial production % change on year ago

- Consumer Price Index % change on year ago

- Trade balance (latest 12-month period)

- Current account balance (latest 12-month period)

- Foreign reserves (latest versus year ago)

- Currency exchange rate versus USD (latest versus year ago)

- Short-term interest rates (%)

- Forecast stock market price/earnings ratio

- EBITDA Growth forecast (%)

- 6-month stock market index estimate (S&P/IFCG Index)

Other factors that are implicitly taken into account in the recommended country rankings include:

- Economic policy framework (monetary/fiscal policy mix)

- Overall health of government finances (budget deficit as a % of GDP)

- Level of inward foreign investment and current account coverage, or level of capital flight (if applicable)

- Exchange rate regime (fixed, free-floating, ‘managed float’), and hence, the ability of a country to absorb external economic shocks through exchange rate adjustment.

Stage 3

The bottom-up stock selection occurs at stage three of the investment process.

The portfolio managers and Research Analysts review and discuss the Macroeconomist’s recommendations. The Investment Management Team then re-ranks the countries based upon the relative value available within the CoL universe of closed-end funds.

The stock selection process at this stage will identify a number of closed-end funds to give the desired country exposure, guided by our country allocation model. In effect, we will have identified the best performing funds, at the widest discounts to NAV, to give the most potentially profitable country exposure. Some of the funds selected will potentially be subject to a corporate event (liquidation, open-ending, etc.) that may lead to an accelerated return of capital at NAV.

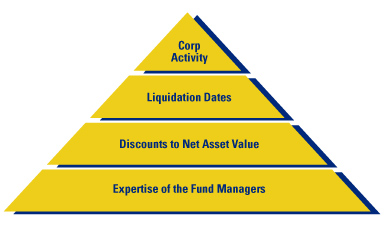

The following four valuation components summarize the key drivers in our stock selection process:

- The historical, net performance of the closed-end fund in NAV terms, versus its benchmark.

- The current discount to NAV of the fund compared to its historical average and its peer group.

- Pre-determined fund liquidation date, if any.

- The potential for the fund’s discount to NAV to narrow due to unitization (conversion to open-ended status), a share buy back program or some other form of corporate activity.

Implementation of the City of London investment philosophy is a dynamic process. It is based upon our assessment of the outlook for the stock markets within the benchmark, coupled with the value available via our universe of emerging market closed-end funds.

While snap-shots of these two components are taken on a quarterly basis, both day-to-day and intra-day stock market and discount volatility in funds create the need for regular portfolio adjustments. The quarterly, monthly, weekly and daily review and implementation process is as follows:

Quarterly: Asset Allocation, Stage 3 Meeting

A formal review of the Macroeconomist’s stock market recommendations for the new quarter is undertaken. This is the key forum for discussing and reaching consensus on overall strategy for the forthcoming quarter. The Investment Management Team re-rank stock markets based upon prevalent value within our universe of closed-end funds. Target weightings for all markets in the universe are established versus the benchmark and input into Investment Management computer models for implementation on a day-to-day basis, via buy and sell decisions.

Monthly: Investment Management Strategy Meeting

Strategy for the coming month is discussed between Portfolio Managers, Research Analysts and the Macroeconomist. The last quarter’s target asset allocations are amended, if necessary, to reflect changes in discount levels of funds, index weightings and anticipated and actual stock market movements.

Weekly: Macroeconomist Presentation

The Macroeconomist makes a presentation to the full Investment Management Team on significant economic, political or social events that have developed over the previous week. Forecasts are provided on any potential impact these developments may have on the relevant stock market indices or currencies. The Portfolio Managers discuss these issues and, in conjunction with the current value available in our universe decide what amendments should be made to the portfolios we manage.

Weekly: Portfolio Managers Meeting

Portfolio Managers meet to discuss important administrative matters that may impact on the investment management process, including business development, enhancements to the investment process and personnel and training issues.

Daily: Daily 8:15 am GMT / 4:15 pm Singapore Time Meeting

The Investment Management Team (IMT) in the UK review overnight stock market performances in Latin America and Asia in conjunction with the Asian Portfolio Manager in a meeting at 8:15 am GMT. Research Analysts discuss new stock-specific information and input is received regarding any important corporate action news released overnight affecting any stock within City of London’s closed-end fund universe. The UK and Asian Portfolio Managers formulate buy and sell decisions based upon the input at this meeting, as well as our longer term strategy and the relative value of London traded or offshore funds versus US or locally domiciled funds.

Daily: Daily 1:30 pm GMT / 8:30 am EST Meeting

At 8:30 am EST the Investment Management Team in the UK and the US jointly review and discuss stock market performances, stock-specific research and other important news. UK buy and sell orders placed and completed in the morning are reviewed, as well as US orders to be placed at 9:30 am EST. This is the key forum to exchange market and stock-specific news items and the implications of these developments on CoL portfolios. The Macroeconomist addresses significant economic events in detail and the Portfolio Managers assess the impact of these events and determine the relevant action to be taken to exploit potential opportunities.

Portfolio Managers are responsible for execution in all instances. At the point at which the Portfolio Manager in any one particular centre is not available another centre will assume responsibility.

Buy and sell orders are placed with a variety of brokers in the UK, the US and a number of local brokers in emerging markets. City of London endeavors to negotiate competitive rates of commission from the brokerage community. We also maintain a minimum deal size and minimum holding size for each portfolio, which ensures fund portfolio friction costs and expenses are minimised.